(This is part one of a short series on illiquid stocks. Look out for part two on investor marketing and illiquid stocks later this week.)

For speculative investors, falling in and out of love with small-caps with soaring potential and illiquid stock is a part of the daily grind. Investors talk themselves in and out of a trade multiple times a day. With the necessity of uncovering stellar companies that are running under the radar before their future potential is priced in, looking at a screen of companies trading in the four to five-digit range just comes with the territory.

But, when investors are hunting down small-cap stocks to buy, they’re considering a lot more than the blue-sky potential of the company. If you’re involved in a small-cap company, there’s a lot you can do to attract the attention of these speculative investors.

Getting investors to seriously consider investing in your small-cap venture requires more than just potential and a good story—it demands a winning strategy to inspire confidence.

Here are three key actions you can take from the helm of a small-cap company to attract and retain more investors, and how you can implement them on your website:

1️⃣ Demonstrate Transparency and Execution

Actions speak louder than words. Small caps must showcase their ability to execute their business plans effectively. By consistently meeting milestones, delivering on promises, and achieving tangible results, they instill confidence in investors who seek proof of potential.

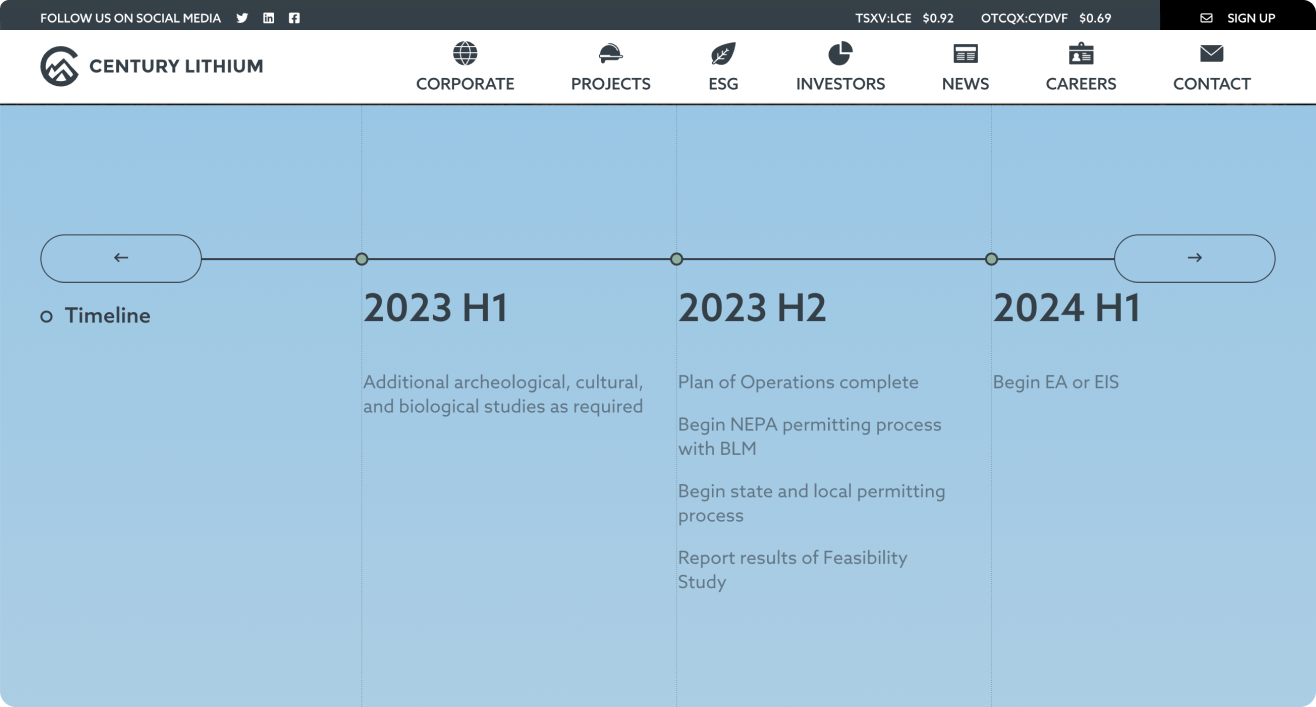

Caption: Century Lithium provides a detailed timeline of past and upcoming key events with a timeline module on their primary project page.

Your site needs to clearly feature your past successes and ongoing initiatives to really spell out the investment thesis for visitors. Key metrics features, timelines, and in-depth analyses of projects can be a fantastic addition to show that your company is genuinely executing its plans. A general road map of future activities is another great way to keep investors engaged in your story as it unfolds.

Put simply, transparency breeds trust. Small-caps must proactively communicate their vision, strategy, and milestones to investors. By providing regular updates and being open about challenges and successes, they build a foundation of trust and credibility.

Caption: US Goldmining’s frequently updated news section

Nothing says “red flag” like the combination of an empty news section (or no news section at all) on a small-cap’s website, combined with a lack of general updates from the company. In the small-cap space, no news can be bad news. Ensure your site is constantly updated with the latest initiatives and announcements, and that they appear prominently.

However, don’t live and die by the news release. If your release schedule is your sole method to keep your audience updated on your activities, that’s a problem. Long stretches of quiet periods without material news make investors antsy. Instead, utilize your newsletter list and social channels to update and engage with your audience. Far too many companies are scared of being social on social media because of the fear of making mistakes and not saying something that’s not allowed. Create an internal social media communication doc with your legal counsel, basically establishing the do’s and don’ts of what you can say and blast away.

2️⃣ Showcase Leadership

Strong leadership is paramount. Small-cap companies should exhibit a clear vision, backed by experienced and passionate leaders who inspire confidence. Investors want to see a capable team driving the company towards its goals, navigating obstacles with resilience.

Caption: White Gold Corp features key team members extensively throughout their site with write-ups and video features.

The stewardship of your company should be obvious through a quick look at your website. On your investor decks and in a dedicated section, you should have detailed profiles of key figures within your company, with clear examples of past successes. The investor needs a reason to trust you with their investment. If key members of your team have notable, relevant exits in their past, or other similar banner items, make sure these feature on your homepage as well.

3️⃣ Write clearly and convincingly

One of the most common mistakes we see small-cap companies make is phoning in the actual written content on their site. Sure, visuals, graphics, and site architecture are essential in compelling investors to pay attention, but when it comes down to it, much of the actual information you’re trying to convey comes down to the actual words on the page.

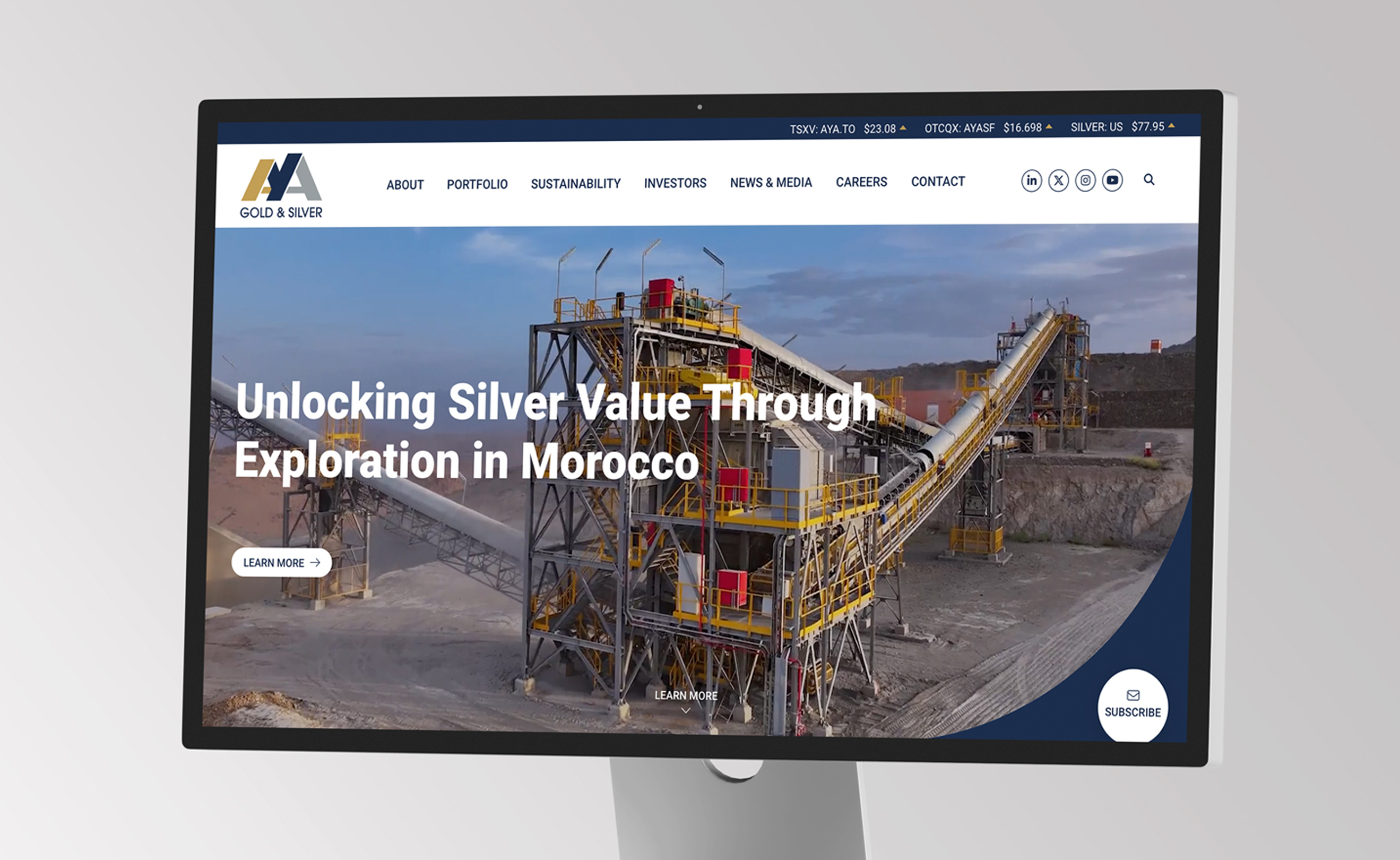

Caption: First Majestic Silver’s tagline immediately grabs the reader.

Writing matters more than you probably realize, especially when you’re trying to convince a naturally skeptical investor that your public company deserves their trust and money. Just as an example: the first thing a prospect will see upon visiting your site is almost certainly your company tagline. If it sounds clunky, sloppy, unmotivating, or a basic placeholder, investors will instantly be on guard toward your company.

This applies to every word on your site: the aforementioned management bios, your project, and company descriptions—everything.

Of course, it’s usually true that higher-cap companies have a superior copy on their site because they have the funds to shell out for a dedicated copywriter. But that shouldn’t stop you from ensuring your copy is as content as it can possibly be.

By embracing transparency, demonstrating execution capabilities, showcasing strong leadership, and writing with skill and care, public companies with illiquid stocks can inspire investors to join them on what can truly be a transformative journey. It’s one of the things that makes this space so exciting.

If you’re a small-cap looking to inspire investor confidence and drive traffic to your site, contact BLENDER to find out how we can help!