LinkedIn is one of the most powerful—and most often overlooked—social media tools for IROs.

The ability to meet investors in the digital spaces where they live and work is essential for any investor relations professional, and LinkedIn is a hub of investor activity. According to a report from LinkedIn, 48% of all institutional investors use LinkedIn, and 61% of those users say they turn to it frequently. 66% of investors with assets over $100,000 say they use LinkedIn at least monthly.

But as powerful as LinkedIn can be, it can also be intimidating for IROs less well-versed in using social media for investor outreach. Here, we’ll give you a few easy strategies to implement LinkedIn into your IR strategy.

Start with simple, informational posts

The best way to get investors engaged with your company on LinkedIn is by being useful to them, and the best way to be useful to investors is by updating them with information on your company.

Posts don’t need to be elaborate, detailed affairs. As long as they provide a tidbit of data that might be interesting or valuable to a user, they’re worth posting. It’s even a good idea to post your latest news releases to your page, perhaps with added context or commentary from your team.

Here are a few good post ideas for LinkedIn:

- Introductions to key members of your team

- News releases + commentary

- Public appearances from members of your team

- Announcements of upcoming conferences you’ll be attending

- Macro-level analysis of your current market

- Reposts of other key information sources or pundits that comment on your industry

The more regular your posts, the better engagement will be. Just ensure that every post has some substance to it—investors can smell fluff pieces from a mile away.

The next level: LinkedIn Newsletter

Once you’ve got a base level of posts coming out, it’s time to elevate your engagement on LinkedIn to the next level with a LinkedIn newsletter.

LinkedIn makes it easy to create an ongoing newsletter, establishing your company as an authority in the space, keeping investors informed on your company’s activities, and keeping your company top-of-mind. It’s a free, built-in feature within LinkedIn, so there’s no real reason not to do it other than time constraints—and it doesn’t take much time.

Follow these simple steps to start a LinkedIn newsletter. Once you do, your subscribers will receive in-app and email notifications whenever you publish, sending your latest posts straight to their inbox. This is incredibly powerful, giving subscribers everything they need to know from your company as it arrives. The articles also show up on your page, making sure subscribers don’t miss anything.

Make sure your profiles are up to snuff

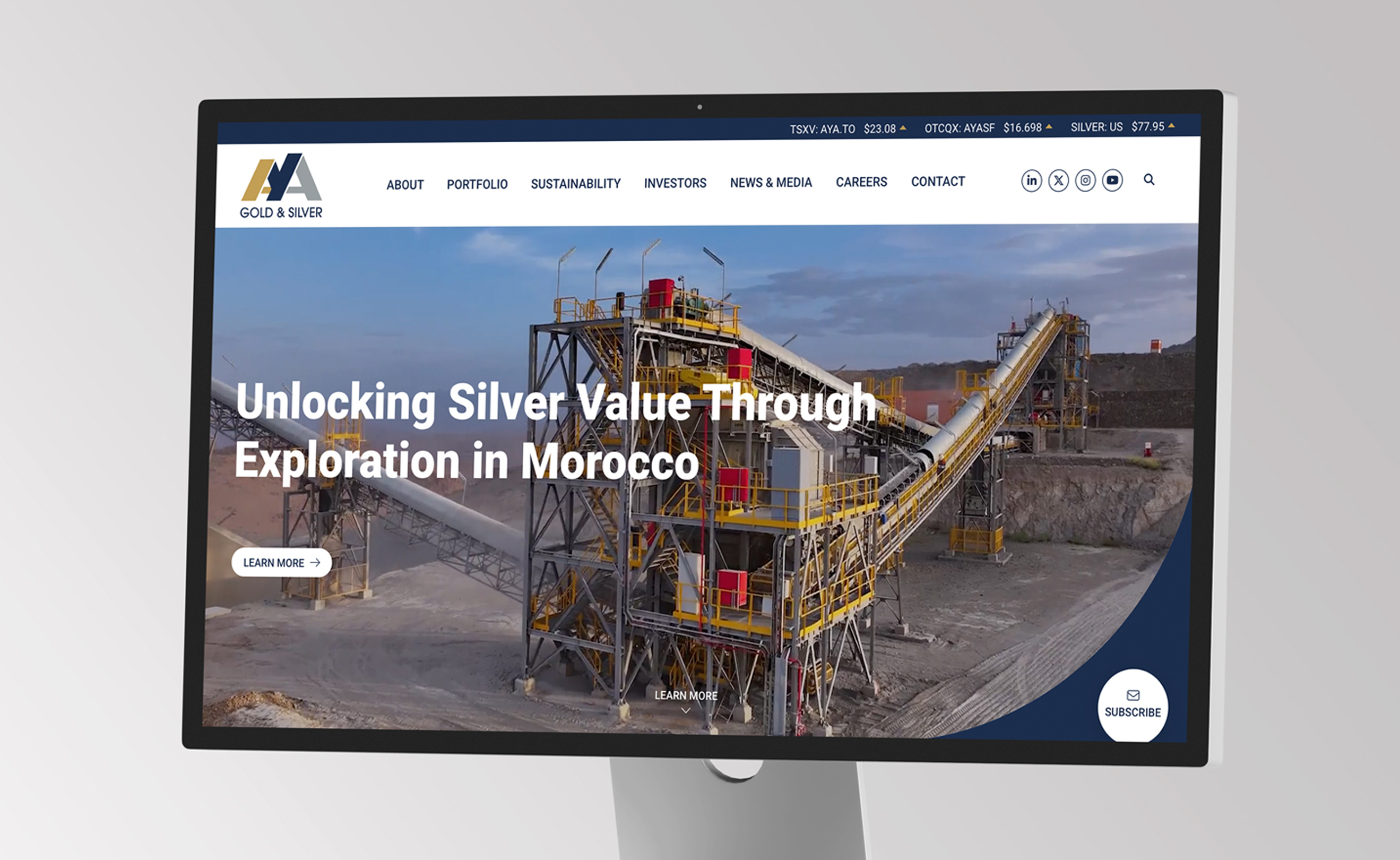

It may seem obvious, but it’s also essential that every profile for a member of your C-Suite, and your company page, are strong and convincing. Members of your team should have professional images and clear writing about what they’ve accomplished in their careers, and how they’re currently serving your company. Your company page should use professional copy (you can draw this directly from your IR site) and eye-catching imagery to build investor trust.

Your LinkedIn page may be an investor’s first interaction with your company, so it’s important that it looks professional and well-thought-out. Nothing diminishes confidence in a public company like sloppy execution, and that includes social media.

LinkedIn is easy, with a little time investment

Once you have your LinkedIn processes in place, it’s a simple matter to keep it up-to-date. You don’t have to be posting every day, but make it useful to investors, and they’ll engage with it. It’s that simple.

In essence, while the initial setup and integration of LinkedIn into investor relations may require some time investment, the platform’s user-friendly features make it a manageable task. Consistency, relevance, and professionalism are key pillars that, when prioritized, can transform LinkedIn into a dynamic and effective tool for investor engagement. As the digital landscape continues to evolve, embracing LinkedIn as a central component of your investor relations strategy is a strategic move that aligns with the preferences and habits of today’s investors.